📢Good morning, today’s Signals are brought to you by CRE 360 Signal™.

The Federal Housing Finance Agency has authorized a sharp expansion in agency mortgage-bond holdings, allowing Fannie Mae and Freddie Mac to significantly increase their exposure to agency MBS. Framed as a move to stabilize mortgage rates, the decision quietly reintroduces a form of quasi-QE—without calling it that—and shifts pricing power away from markets and toward policy balance sheets.

➤ SIGNAL

Under new guidance from FHFA Director Bill Pulte, Fannie Mae and Freddie Mac are once again permitted to accumulate large portfolios of mortgage-backed securities, with internal limits reportedly moving toward roughly $225 billion per agency. The move aligns with broader federal efforts to dampen mortgage volatility and nudge rates lower without direct Federal Reserve intervention.

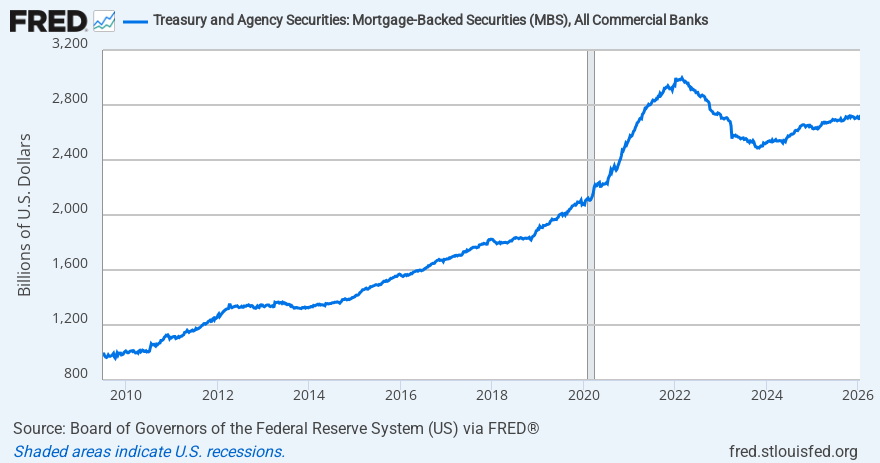

On the surface, the logic is straightforward: when agency buyers step in, spreads tighten, funding costs fall, and mortgage rates ease—at least temporarily. But the scale matters. In a U.S. mortgage market exceeding $12 trillion, a few hundred billion in incremental buying doesn’t reset fundamentals. It smooths the edges while leaving structural affordability and supply constraints untouched.

What is materially changing is who absorbs duration and convexity risk. As the Fed remains sidelined, that exposure migrates to the GSEs themselves. Larger retained portfolios mean greater sensitivity to rate moves, prepayment behavior, and political scrutiny—particularly as privatization conversations resurface. This also raises a subtle moral hazard: when agencies are tasked with rate suppression, underwriting discipline can quietly weaken at the margins.

FHFA has paired this move with higher multifamily lending caps for 2026, signaling a willingness to inject liquidity into apartments as well. Yet liquidity doesn’t solve negative leverage or operating cost inflation. Owners may refinance more easily, but the underlying cash-flow math hasn’t improved.

Takeaway

his policy likely won’t fix housing affordability or sustainably lower rates. It will, however, compress spreads in the short term and relocate risk onto government-backed balance sheets. Investors and operators should treat today’s rate relief as temporary policy insulation—not a new equilibrium—and underwrite accordingly.

CRE360.ai — Daily Signals & Commercial Real Estate Intelligence

Part of the 2025 Year-End Intelligence Series.

▼ EDITORIAL DESK TOP PICKS

Md. real estate firm to develop Delaware mixed-use community — St. John Properties enters the Middletown, DE market with a 75-acre flex/R&D, retail, and residential development called Middletown Exchange.

I-78/I-81 CRE corridor ends 2025 on a high note — Lease activity improved late in 2025, suggesting momentum heading into 2026 despite elevated vacancies.

Public meeting may decide fate of 9 federal properties — Charleston area could see redevelopments or divestitures affecting Florida, Georgia, and South Carolina federal CRE assets.

REBNY gala highlights NYC real estate resurgence — New York reported a 26% investment sales jump in 2025 with billion-dollar deals and office leasing gains despite macro pressure.

Port-fueled growth to expand Laredo CRE in 2026 — Laredo’s strategic port role is driving warehousing, hotel, and industrial investment interest, albeit with housing affordability concerns.

Orbital raises $60M to automate real estate law with AI — Proptech funding for legal automation highlights rising AI adoption to streamline complex CRE transactions.

Mixed-use property in Manhattan’s SoHo sells for $43.7M — Office/retail real estate continues to trade in core NYC neighborhoods despite macro caution.

Namdar buys 1.05M-SF Houston office for $66M — Distressed office acquisition underscores opportunistic capital flows in secondary office markets.

U.S. office markets show improvement but challenges remain — Colliers reports Q4 2025 data pointing to stabilization in select office submarkets, yet fundamentals lag broader CRE recovery.

St. Louis industrial market posts solid footing to start 2026 — Healthy leasing and manageable new supply put Midwest industrial markets in a relatively strong position.

Des Moines posts first positive office absorption since 2017 — Smaller markets may lead early office recovery phases as tenant demand resurfaces.