📢Good morning, today’s Signals are brought to you by CRE 360 Signal™.

After a 24-month repricing and supply surge, multifamily is entering a new phase. Values have stabilized. Rents are flat. Cap rates have widened. And capital — long cautious — is starting to look for re-entry. But not all markets or assets will recover equally. This piece highlights three data-backed signals that will separate the outperformers from the rest in 2026–2027.

➤ SIGNAL

Sun Belt Supply Shock Is Peaking — and Repricing Is Already Here

From 2020 to 2023, Sun Belt metros captured outsized investor capital — and outsized construction. Now they’re digesting that pipeline:

Charlotte, Austin, Phoenix, and Nashville will see new supply equal to 4–6% of existing inventory in 2026(RealPage)

Austin alone will add ~19,000 units in 2026 — 5.9% of stock, more than any other major metro (Yardi Matrix)

Rents fell 5–8% YoY in 2025 in markets like Austin (–5.2%) and Phoenix (–4.1%), after 30%+ gains in 2021–2022 (RealPage, CoStar)

But here’s where it flips: construction starts in these metros are down 40–60% from peak, and supply is expected to fall off a cliff by 2027. Investors who can absorb 12–18 months of flat or negative NOI — and price in current rent softness — will be entering just as deliveries collapse and demand re-tightens. Many of these markets are historically volatile but cycle-fast.

Signal 2: The Midwest Is Quietly Outperforming on Core Metrics

In a year when national rent growth was 0%, some of the steadiest gains came from markets that rarely get headlines:

Chicago: +3.6% rent growth YoY (CoStar Q4 2025)

Cincinnati, Kansas City, Indianapolis: +2.5–3.2% (RealPage)

Occupancy stable at 95%+, with minimal concessions and new supply near 20-year lows

Why? Fundamentals:

These metros didn’t overbuild

Homeownership remains unaffordable (mortgage rate lock-in)

Local economies (healthcare, logistics, insurance) provide steady renter demand

Core and core-plus buyers seeking cash-on-cash return can capture 4.75–5.25% cap rates on stabilized Class B assets — with rent and expense volatility materially lower than coastal or Sun Belt metros.

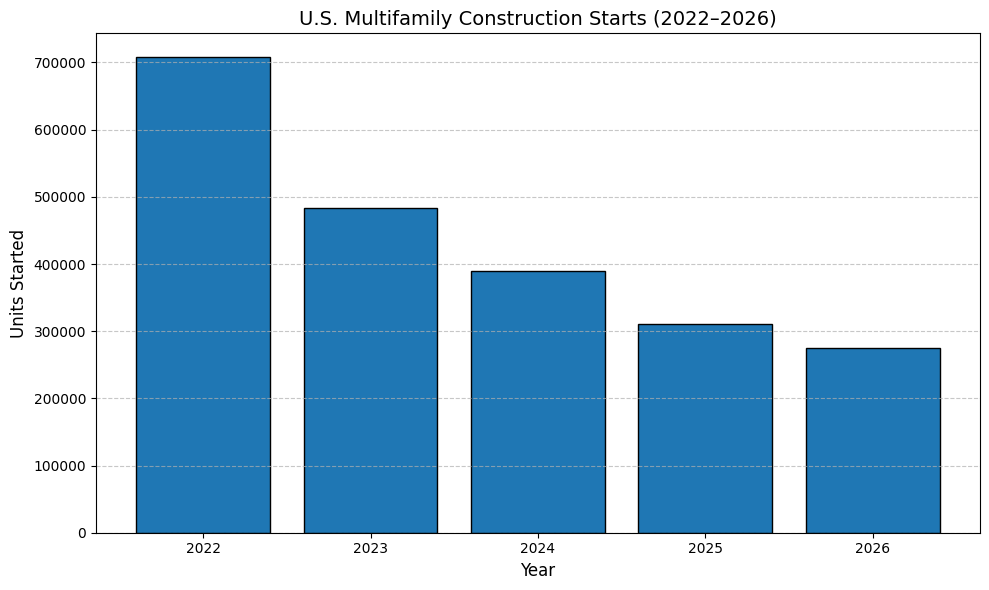

Signal 3: Construction Pipeline Collapse Sets Up 2027 Undersupply

Multifamily starts are falling off a cliff:

2022: ~708,000 units started

2023: ~483,000

2024: ~389,000

2025: ~311,000 (estimated)

2026 forecast: ~275,000 (RealPage, Yardi Matrix, Census)

This is the lowest pace since 2012, and most of what’s delivering in 2026–2027 was financed before rates spiked. After that, supply flatlines.

Meanwhile:

Absorption in 2025 remained positive: ~366,000 units, nearly matching the 5-year average (RealPage)

Job growth and wage growth support renter demand, especially in markets with returning office employment and STEM hiring (BLS, JOLTS)

Assets that stabilize in late 2026 or 2027 will face little new competition. Landlords will regain pricing power, especially in metros with barriers to new starts (zoning, land, capital constraints). This isn’t priced into most pro formas today.

hart showing the collapse in U.S. multifamily construction starts from 2022 through the 2026 forecast.

Why 2026 Isn’t About Yield — It’s About Positioning

Buyers expecting high Day 1 yields will get disappointed. But those underwriting flat 2026 performance and positioning for late-2027 NOI acceleration will win the cycle.

Cap rates have reset

Debt markets are thawing (agency caps reset, regional banks returning)

Construction is retreating

Demand remains structurally intact

If you’re waiting for 2019-style metrics to return, you’ll miss the window. This is a build-year — for IRR, for NOI stack, and for capital planning.

CRE360.ai — Daily Signals & Commercial Real Estate Intelligence

Part of the 2025 Year-End Intelligence Series.

▼ EDITORIAL DESK TOP PICKS

CRE investors plan to buy more in 2026 — A CBRE survey finds 74 % of CRE investors intend to increase acquisitions this year, signaling rising confidence despite macro concerns.

Vancouver real estate market headlines for late Jan – Feb 1 — Regional CRE activity and council decisions highlight project and transaction news in the Vancouver market.

Maine CRE sales roundup for January 2026 — A weekly summary from Mainebiz lists key commercial property transactions in the state.

CRE for credit unions: risk and opportunity in 2026 — A strategic view for credit unions on navigating fluctuating rates, borrower needs, and CRE loan performance.

Connect Media acquires Networld to expand CRE news and conferences — The deal strengthens one of the largest CRE news and events platforms in North America.

Hot Properties: SC commercial real estate transactions — Weekly South Carolina CRE deals, including retail and specialty property activity.

Melissa Clarke takes over as CREW NJ president — New leadership in CREW NJ aims to expand networking and professional development in the regional industry.

Eliot Spitzer’s firm buys Stamford parcels for development — Spitzer Enterprises acquired key CT sites for transit-oriented development near Stamford’s rail hub.

Big-city office buildings are driving CRE price gains — National pricing data shows a 3.8 % annual rebound in office values as investor confidence stabilizes.

2026 CRE trends to watch: tech, capital, and tenant shifts — Legal insights highlight how evolving tenant demands and tech adoption are shaping CRE strategy this year.

CRE injected $1.55T into the U.S. economy in 2025 — A new NAIOP report shows CRE’s significant GDP contribution, jobs creation, and economic impact last year.

CRE events calendar shows upcoming industry gatherings — Conferences and sector events scheduled in Feb/March offer networking and insight opportunities.

Foreign CRE capital rethinking U.S. investment posture — Global investors are cautious but not retreating amid political and policy uncertainty.

Trend analysis highlights U.S. CRE housing market divergence — New research shows the housing/rental market splitting into distinct winners and losers.

CRE marketing and intelligence platforms are consolidating — Connect Media’s acquisition indicates media consolidation and a bigger footprint in CRE content.

Regional VC and CRE risk focus for credit unions — Credit union CRE portfolios face sector challenges as lending conditions shift.

Weekly Vancouver real estate headlines reflect broader CRE trends — Regional roundup sheds light on local absorption and approval news.

Maine sales roundup shows CRE transaction momentum — Asset sales across varied property types continue in secondary markets.

Leadership shifts in New Jersey CRE network — Organizational growth and networking opportunities are front of mind for CRE professionals.

Transit-oriented development picks up in Stamford — Strategic acquisition positions Stamford for growth tied to commuter rail and urban densification.