➤ Key Highlights

Lone Star priced a $385M non-prime RMBS with AAA spreads around 105 bp over the I-curve.

Pricing landed roughly 5 bp tighter than recent comparable transactions.

Demand remains strongest at the senior AAA level despite mixed collateral performance.

Tightening in RMBS can influence spread behavior across other securitized markets, including CMBS.

Lone Star Residential has successfully priced a $385 million non-prime residential mortgage-backed securities (RMBS) transaction, with its AAA tranche clearing at approximately 105 basis points over the interest-rate curve. The deal priced about five basis points tighter than similar transactions brought to market earlier this month, underscoring continued investor appetite for senior securitized credit.

The transaction comes amid uneven performance metrics in the underlying non-prime mortgage market, where delinquency trends remain mixed. Despite these fundamentals, investors continue to prioritize highly rated tranches that offer relative yield without direct exposure to subordinate credit risk.

Market participants view the tighter pricing as a technical signal rather than a reflection of improving collateral fundamentals. Strong demand at the AAA level reflects a broader search for yield within structured products, particularly where credit enhancement and structural protections remain robust.

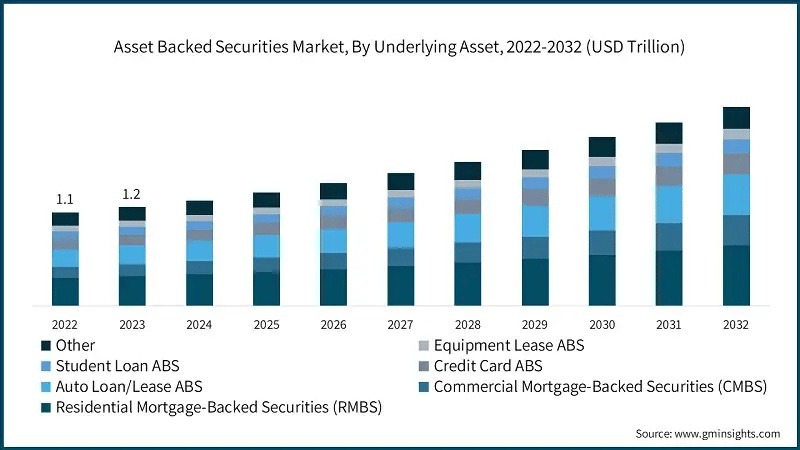

Although the deal is backed by residential assets, its implications extend beyond RMBS. Senior tranches across securitized markets often compete for the same risk capital. As AAA RMBS spreads compress, pricing pressure can emerge in adjacent sectors such as commercial mortgage-backed securities (CMBS), especially at the top of the capital stack.

➤ TAKEAWAY

Tight AAA RMBS pricing reflects technical demand for senior risk, which may indirectly compress spreads across other securitized credit markets.